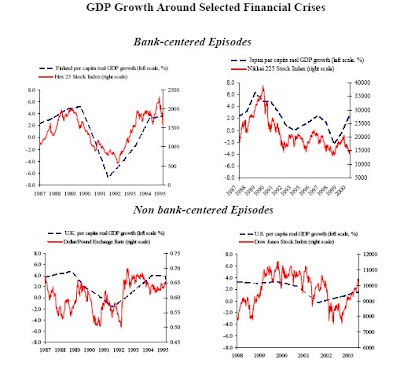

- Not all booms are alikeWhat may matter is not so much the asset price boom in itself, but who holds the assets and the risk, how the boom is financed, and how an eventual bust may affect financial institutions. The degree of leverage associated with the funding of a boom and the degree of involvement of banks and other financial intermediaries will determine the magnitude of balance sheet effects and the dangers to the supply of credit in a bust.

- The case for policy intervention depends on how a boom is financed and how risk is held. Asset price booms supported through leveraged financing and involving financial intermediaries should be dealt with, since they entail risks for the supply of credit to the economy; other booms could more likely be left to themselves.

- The mandate of monetary policy should include macro-financial stability, not just price stability. To the extent that the build up of systemic risk can portend a sharp economic downturn, and to the extent that regulation cannot fully prevent such a buildup, it is now clear that policy makers cannot neglect asset-price and credit booms. That said, prudential measures provide a more targeted and less costly policy solution than interest rate changes and should be a central element of an integrated policy response

- The crisis also highlights two important lessons for fiscal policy. The first is that, in many countries, budget deficits were not reduced sufficiently during the boom years when revenues were high, which limits the fiscal space needed to fight the crisis. The second has to do with the structure of taxation. In most countries, the tax system is biased toward debt financing through deductibility of interest payments. This bias to higher leverage increases the vulnerability of the private sector to shocks, and should be eliminated.

-IMF Executive Board Discusses "Initial Lessons of the Crisis"

Initial Lessons of the Crisis

Initial Lessons of the Crisis for the Global Architecture and the IMF

Lessons of the Global Crisis for Macroeconomic Policy

Lessons of the Financial Crisis for Future Regulation of Financial Institutions and Markets and for Liquidity Management

Video

Press Briefing on Lessons of the Financial Crisis, IMF

No comments:

Post a Comment